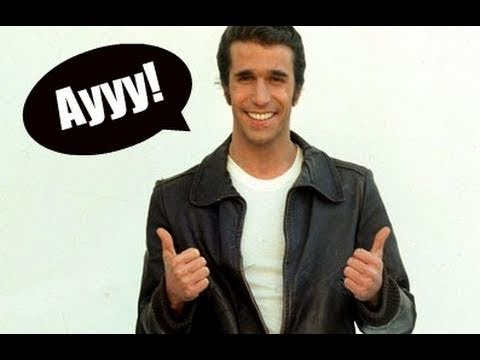

Ayyy! Crude’s Back in the Fifties

Sunday Monday happy days, Tuesday Wednesday happy days, Thursday Friday happy days, Saturday what a day, Rockin’ all week for you. For those of you who are pining for the 50’s, well….oil prices are back to the 50’s! With the confluence of news coming out revolving around increasing global supply while demand recedes, it’s only a matter of time that contango is right around the corner. Take it from ExxonMobil’s recent earnings conference call: “It is clear that this uncertainty is weighing on economic forecast causing significant volatility in raising the prospects of slower growth. Coupled with the threats of increased OPEC supply, we are seeing significant downward pressure on prices and margins.” These guys know what’s going on in the world and they don’t mess around. Indeed, The Tank Tiger has seen a spike of interest in crude oil storage. What’s even more remarkable is we recently back-tested our storage demand and pricing data and created a white paper outlining the signal & alpha. The White Paper outlines how a 3-month moving average of our data is a predictor of inventory totals and direction a month before this information becomes available. If anyone is interested in seeing this data, just drop us a line. Things haven’t been this good for the terminal business since Fonzie jumped the shark. The highly coveted storage is going to be snapped up quickly. For now, The Tank Tiger is still actively showing millions of barrels of storage. If you’re looking for storage, any kind of storage (crude oil, refined products, chemicals, railcars, transloading), our service is free to use! Don’t be a Potsie.

How can things turn on a dime so quickly within such an enormous marketplace? Consider the fact that oil is indeed an inelastic commodity, and the world is thirsty for 100 million barrels a day of it. Presently, OPEC+ adding only 400,000 barrels per day of production to the market can swing things dramatically. Now there are talks of 1,000,000 BPD increase by June! Want a visual analogy?…Picture two giant sumo wrestlers sitting on opposite ends of a see saw, perfectly balanced. Now put a baby in the lap of one of the sumo wrestlers….and the see saw will quickly plummet downwards to the baby side. Indeed, the EIA projects global stock builds. The US-China tariff disputes are dampening global economic growth forecasts, leading to a reduced outlook for oil demand. The trucks will stop rolling. Diesel will build up. Refiners will cut back and crude will pile up. We’re not haken a tshaynik. This bearish sentiment weighs on near-term prices. Look at the strip…next year is firmly in contango already. The eight OPEC+ countries will meet on 1 June 2025 to decide on July production levels. The Saudis are not happy with the non-compliant countries and it could be time for the woodshed. Crude prices dropped about 4%, below $56 a barrel, late Sunday. Welcome to the Fifties! Ayyy!