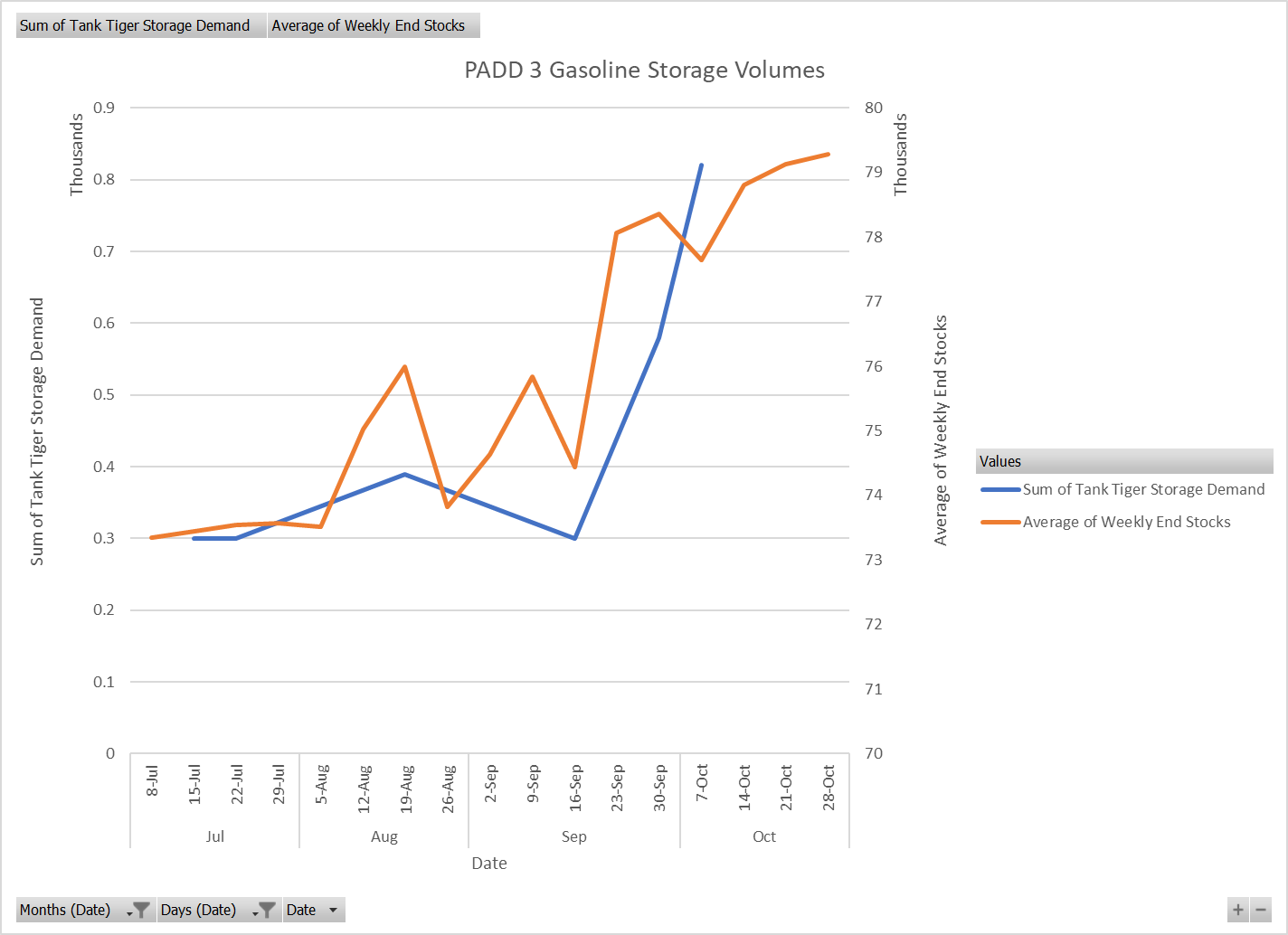

Comparison Report: PADD 3 Gasoline Storage Demand (The Tank Tiger) vs. EIA Weekly End Inventory Levels

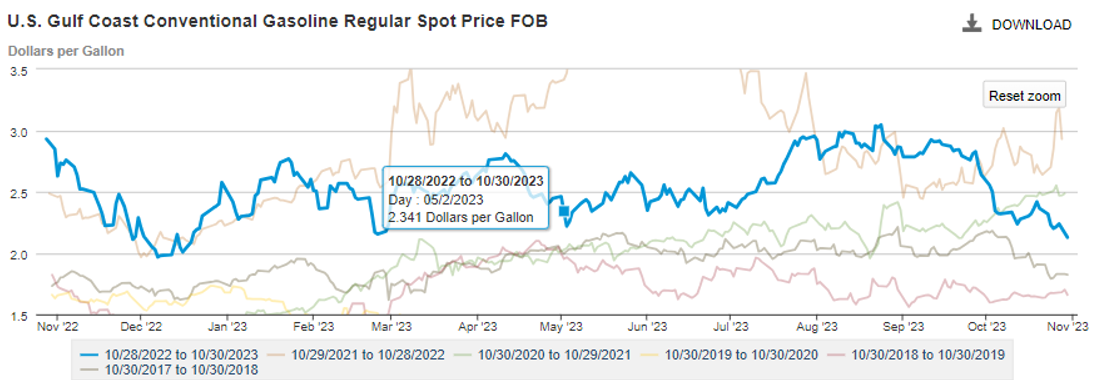

The U.S. Gulf Coast has recently witnessed a remarkable downturn in gasoline prices, marking the lowest points in 2023. Prompt CBOB values at $2.024/gal, trading at a 19.25cts/gal discount to the RBOB futures contract, reflecting new 2023 lows. This trend has spotlighted gasoline’s sharp inventory build in the latest months. Refineries are continuing a high run rate for diesel and jet fuel production, due to strong demand. Comfortable margins on diesel and jet fuel, offsetting the losses incurred in the gasoline sector could see a continued surplus in gasoline supply.

In analyzing the Tank Tiger storage demand alongside the EIA’s weekly end stocks reveals the build inventories correlates directly to The Tank’s Storage demand data. Mid-September’s simultaneous increase in both Tank Tiger storage demand and the EIA’s weekly end stocks suggests a surge in gasoline storage demand, met by an increase in inventory levels. This wasn’t just a minor fluctuation but a robust surge, indicating a potential shift in the market dynamics.

If the demand for distillates continues its robust trajectory throughout the winter months and refineries persist in operating at elevated capacities, the enduring pressure on gasoline prices seems inevitable. As the holiday season approaches, there is a possibility of inventory depletion due to increased demand, particularly during this period. However, drawing down the surplus may prove to be a challenging task given the existing surplus levels. The prospect of more affordable prices at the pump is likely to stimulate increased travel, as consumers are incentivized by the lowered cost of fuel. The convergence of these factors creates an intriguing and complex scenario for the upcoming holiday season.