Unveiling the Jet Fuel Market: The Tank Tiger’s Data Reveals Price Drops and Supply Surges

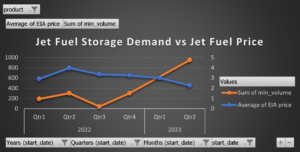

The chart illustrates the relationship between jet fuel storage demand and the price of jet fuel over a specific period. It shows that just before the price of jet fuel experiences a significant decline, there is a noticeable spike in the demand for jet fuel storage.

Based on The Tank Tiger’s proprietary storage demand data, jet fuel’s storage spike demand in late Q4 preceded the drop Jet Fuel’s price (EIA). With storage demand indicating an increase in inventory levels, The Tank Tiger data provides significant signal that there is an over supply causing a price drop.

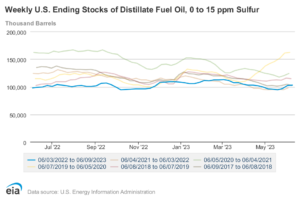

The Tank Tiger is forecasting that refiners will adjust by producing less Jet & more diesel. Diesel is in Backwardation with inventory levels lower than traditional seasonal averages based on the EIA chart below. Potentially this swing could increase Heating Oil inventory during the summer when demand is traditionally lower.

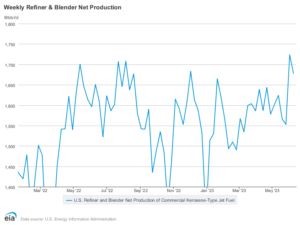

Overall refining production of Jet increased from May – June 2023 and combined with climbing inventories this was a recipe for price decline. Refiners will adjust and curb production, but drawdowns of current inventory levels will take some time. Demand is stagnant, the market could see inventory stagnation which will put pressure on price. If contango widens, traders will look to non-traditional storage locations to park barrels, which could build inventories even more

Want to stay ahead of the market or see unique insights? Reach out for info on The Tank Tiger Data service package